Over the past few years, we have conducted an Iraq Employment Outlook Survey and delivered a report on the results to clients and respondents. The sample results have served well in understanding employer attitudes towards aspects of hiring and skill development.

Today, we'd like to deliver a comparison report to show how change has happened over the course of these yearly surveys, and what we predict will happen in the near future.

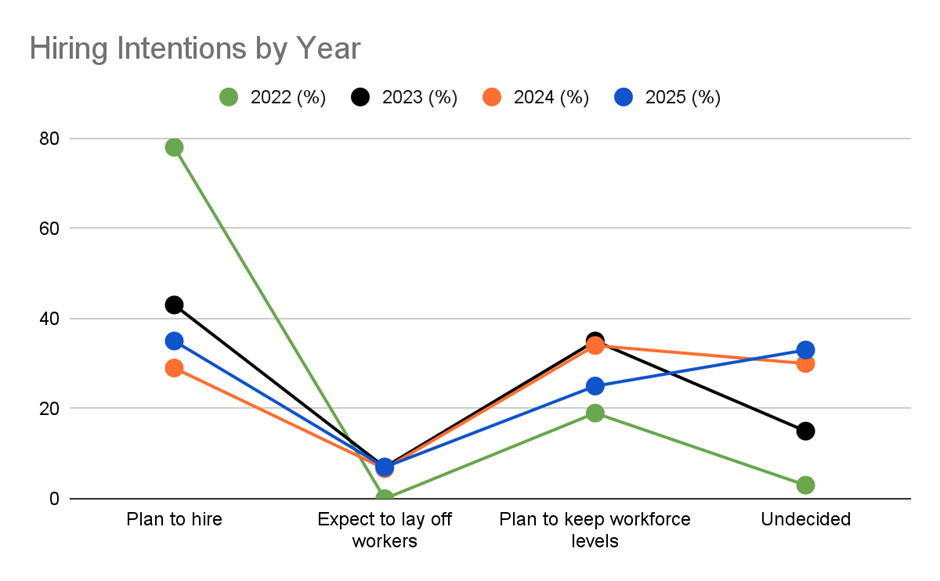

Sampled Employer Hiring Intention Change from 2022 to 2025

In 2022, there was significant hiring growth in northern Iraq, primarily from the Kurdistan region. This came with economic development and the emergence of a broader private sector. Over time, this settled with central Iraq becoming the focus of hiring activity, once again.

However, a year-on-year GDP decline post-2023 (a little later than the global issue) has left our surveyed employers conscious about employee investment, as seen by the rising number of those 'undecided' about hiring. This being said, there have been no worrying increases in expected layoffs, which have remained stable at around 7% among respondents.

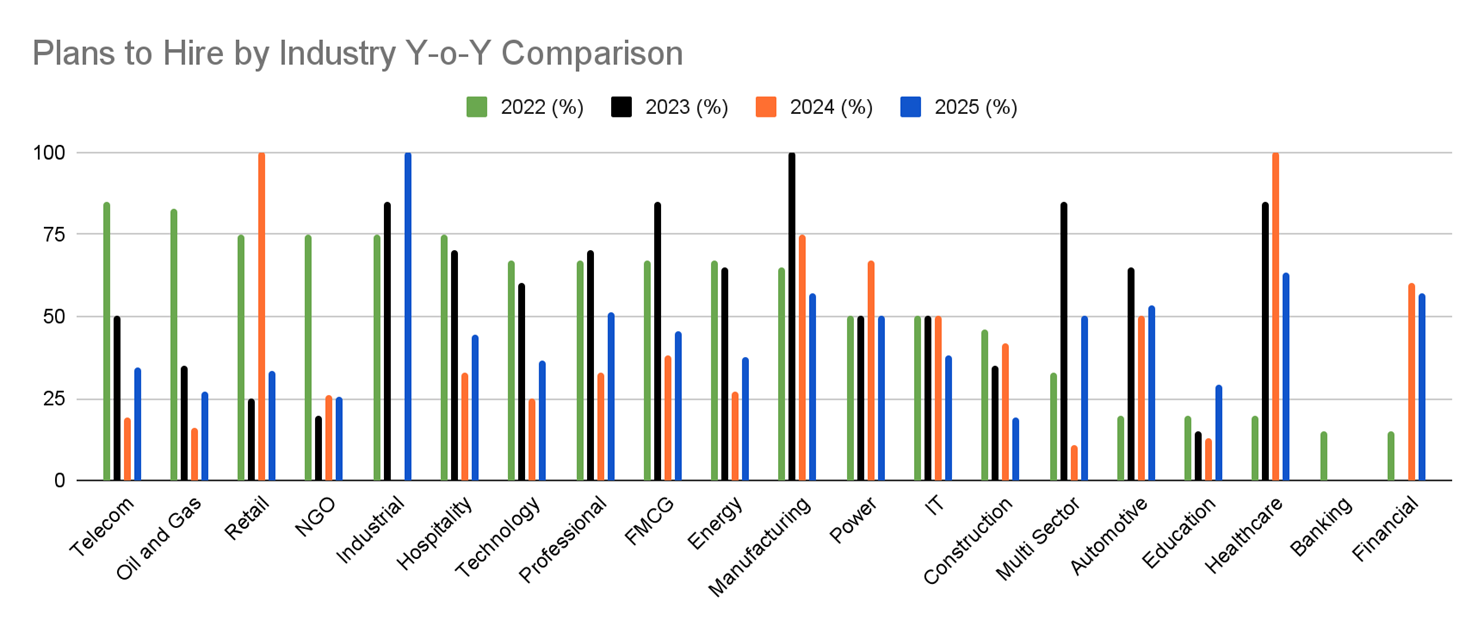

Plans to Hire by Industry from 2022 to 2025

Although our sample of employers has generally felt more undecided year on year across our surveys, there have been better exceptions among individual growing industries. For example, retail, manufacturing, healthcare and industrial sectors have seen a significant surge in hiring intentions in recent years. Healthcare, in particular, has risen due to a larger investment and interest from international companies as the healthcare system improves and digitises.

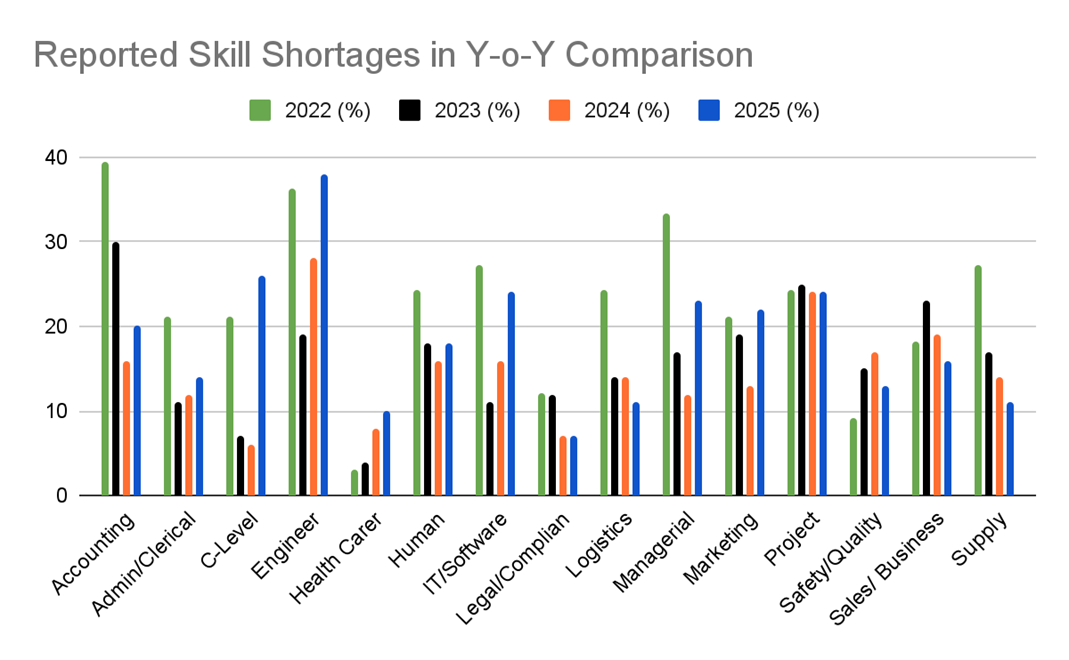

How Skill Shortages Have Impacted Hiring Intentions Y-o-Y

As GDP shifts away from traditional Iraqi oil and gas sector reliance, we have seen a bigger need for skills in growing industries. In 2022, skill demand was relatively high across the board for positions in rising industries and throughout company structures. However, we are pleased to see that the initial need declined among our respondents and clients in later years, partly due to our workforce consulting and outsourcing services, and expanding training course catalogue.

In 2025, a new uptick has been identified for skills like engineering, IT, managerial and project management, and we identified a 23% increase in expected training course enrollment (up from 44% in 2024 to 67% in 2025).

We expect to see this trend dip over the next few years, as we work with clients to fill those gaps with top talent staff and increased L&D opportunities.

Considerations for the Future

As new industries gain traction in the Iraqi economy and foreign investment increases, we expect to see a continued fluctuation in both hiring intentions and skill gaps. However, there is a strong workforce ready to learn new skills, and the country offers good prospects for foreign nationals, so we expect to see a continued fall in newly identified numbers year on year.

Therefore, we would advise two things:

Companies should invest in L&D consultation early to anticipate and plug potential skill gaps before they become problematic: This will ease hiring burdens and costs where you have a pool of in-house talent to draw from. It will also improve market competitiveness as sectors grow.

New sector companies should consider workforce consultation and outsourcing to ease mobilisation and immediate hiring challenges: Entering a new market or delivering a new startup requires top talent across the board. Using an EOR with a network of job-ready candidates is a great way to ensure compliant staffing from day one.

Contact mselect today if you need help with a suite of tailored L&D courses or finding a job-ready team.

*Iraq Employment Report Advisory Note

Please note that our findings are taken directly from our survey data. Changes in responses and respondee numbers have been taken into account when making recommendations and predictions from this sample.

Looking for Our Full 2025 Survey Results?

Are You an Iraqi Employer? Would you like to take part in our 2026 survey?

Express your interest here and we will send you the link as soon as our survey opens.